We find ourselves amidst the most revolutionary technological transformation ever witnessed in the annals of the automotive industry. It transcends a mere transition from internal combustion power to electrification; with each successive generation of cars gracing dealership lots, the capability of essentially driving themselves surpasses that of their predecessors.

Indeed, our progress toward achieving true autonomous driving has lagged behind the optimistic predictions made five or six years ago. Nevertheless, we’ve now arrived at a juncture where approximately 70 percent of newly sold cars incorporate some variant of Advanced Driver Assistance Systems (ADAS). The development of these systems commands extensive research and investment from every major automotive manufacturer globally, while their suppliers are equally committed to propelling us towards a safer future, ultimately leading to a driverless one.

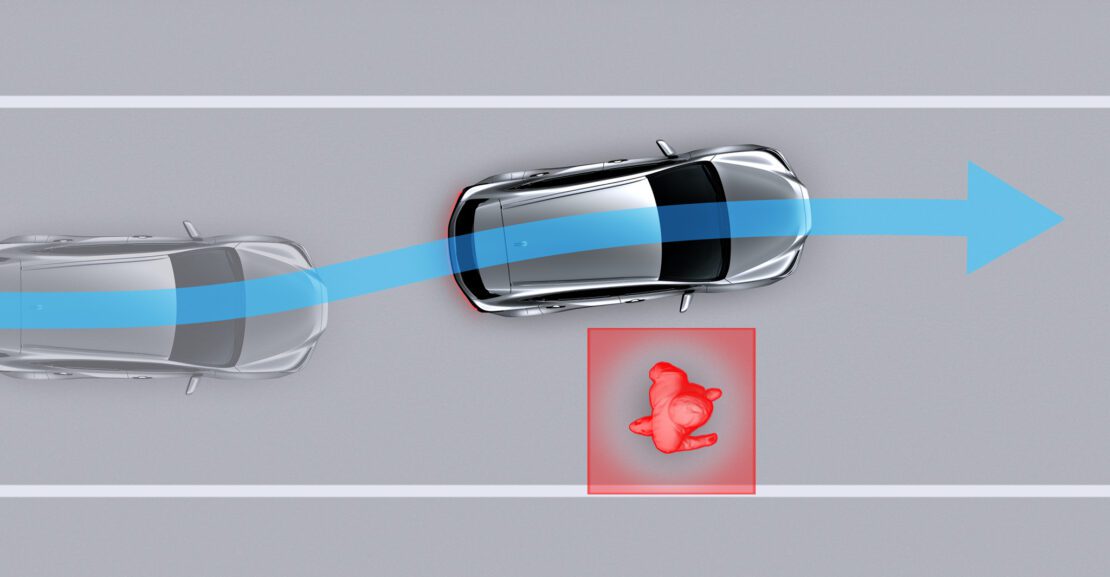

Although software development, particularly in neural networks and various facets of machine learning, tends to dominate headlines, the forthcoming advancements in advanced driver assistance systems (ADAS) demand increasingly sophisticated sensors for perceiving the surrounding environment. Integrated radar sensors, once exclusive to high-end vehicles just a few years ago, have become nearly ubiquitous across various price ranges. Soon, these radar sensors will be complemented by LIDAR sensing and other technologies, empowering a greater number of vehicles to enhance their vision, detect objects more frequently, and extend their awareness to even greater distances.

What can we expect from these sensors in tomorrow’s cars? We talked to some of the industry’s biggest suppliers and an automaker leading in the field to find out.

More Sensors in More Places

Predicting the future is always a challenge, but one discernible trend is so apparent that its trajectory is easily extendable: Tomorrow’s vehicles will boast a significantly greater number of sensors compared to today, marking a substantial leap. Volvo exemplifies a prime illustration of this evolution. In the current top-tier XC90 luxury SUV, three radar sensors are employed—one in the front and two diagonally positioned at the rear. However, in Volvo’s upcoming electric crossover SUV, the Volvo EX30, priced below $35,000, the sensor count rises to five radar sensors.

Taking this trend further, Volvo’s forthcoming electric Volvo EX90, a large SUV, pushes the boundaries even more with five radar sensors, eight cameras, and, notably for Volvo, LIDAR. Thomas Broberg, Volvo’s senior technical adviser for safety, emphasizes that the aim isn’t merely to inundate drivers with more information. In this context, the increase in sensors not only translates to detecting a broader range of elements but also signifies a heightened intelligence in identifying genuine threats, filtering out false positives, and ultimately fostering a safer, less distracting driving experience.

Next-Gen Radar

Reflecting on the trajectory of radar sensor development, advancements in size, resolution, and accuracy have been nothing short of remarkable since their inception decades ago, according to insights from Bosch’s Chakraborty. The weight of Bosch’s radar sensors, for instance, has reduced significantly from 600 grams to a mere 75 grams. Meanwhile, their range has doubled from 150 meters to 300, and their field of view has expanded from 6 to 60 degrees, providing a more comprehensive perspective on the surrounding environment.

These strides forward come with a simultaneous decrease in costs, a pivotal factor enabling manufacturers to integrate numerous radar sensors into affordable vehicles like the Volvo EX30. Beyond contributing to smarter driver assistance systems and paving the way for autonomy, these additional sensors introduce practical features. Bosch, for instance, is actively developing a rear-facing radar system capable of detecting trailers being towed, automatically extending blind-spot warnings to match.

While the range of radar sensors has seen significant improvements in the past decade, the focus is now shifting towards enhancing fidelity. The introduction of 4D, or imaging radar, represents a substantial leap forward. Magna’s Jenkins highlights the significance of imaging radar, especially in addressing challenges associated with close objects and reflective surfaces. This technology enables higher fidelity, allowing differentiation between various objects such as bridges and fence posts. Bosch is actively involved in this domain, achieving a separation of one degree and the ability to track objects with precision, even distinguishing between a large truck and a motorcycle in close proximity.

Notably, despite these enhancements, the electrical consumption of radar sensors has remained constant. Bosch’s Chakraborty emphasizes that the power requirements have stayed the same, showcasing the ability to achieve more without increasing energy consumption. As vehicles become more potent with enhanced Electronic Control Units (ECUs) capable of processing substantial data, sensors can potentially streamline their processing, reducing individual sensor consumption to as little as four watts—less than half the consumption of a household LED light bulb.

Efficiency gains become particularly critical in the context of the shift towards electric vehicles, where power sensitivity is paramount. Low-power radar systems are also finding applications within the vehicle cabin, with 60GHz radar systems approved for use. These internal radar systems, as exemplified by Volvo’s EX90, are initially geared towards occupant detection to prevent instances of individuals being inadvertently left inside locked vehicles.

Volvo, in its pursuit of safety, is leveraging internal radar systems not only to avoid accidents but also to prevent situations that might lead to them. The focus extends to detecting when drivers are not in an optimal state for driving, addressing factors such as stress or intoxication. This information could complement existing driver monitoring systems, aiding in the identification of signs like slouching posture. Moreover, the data might inform next-generation airbag systems to deploy more effectively based on the occupant’s position during a crash. The potential applications of radar sensors continue to evolve, promising increased safety, efficiency, and innovation in the automotive landscape.

Next-Gen Lidar

As of today, radar stands as a well-established technology in the automotive realm, with numerous suppliers providing sensors of various sizes, costs, and capabilities, all engineered to endure the lifespan of a vehicle. Conversely, LIDAR represents a relatively newer technology in the automotive landscape.

However, this paradigm is undergoing a shift. In the early stages, LIDAR applications for autonomy testing and development were not deemed “automotive-grade,” according to Elad Hofstetter, Chief Business Officer at Innoviz. Presently, the company is actively working on LIDAR sensors that, as per Hofstetter, are designed to withstand 15 years of automotive exposure.

Innoviz, a global LIDAR technology supplier, collaborates with automakers, including BMW. The current emphasis of their efforts is primarily directed toward expanding the operational design domain (ODD) of LIDAR sensors, signifying a pivotal step in enhancing the reliability and applicability of this technology in the automotive industry.